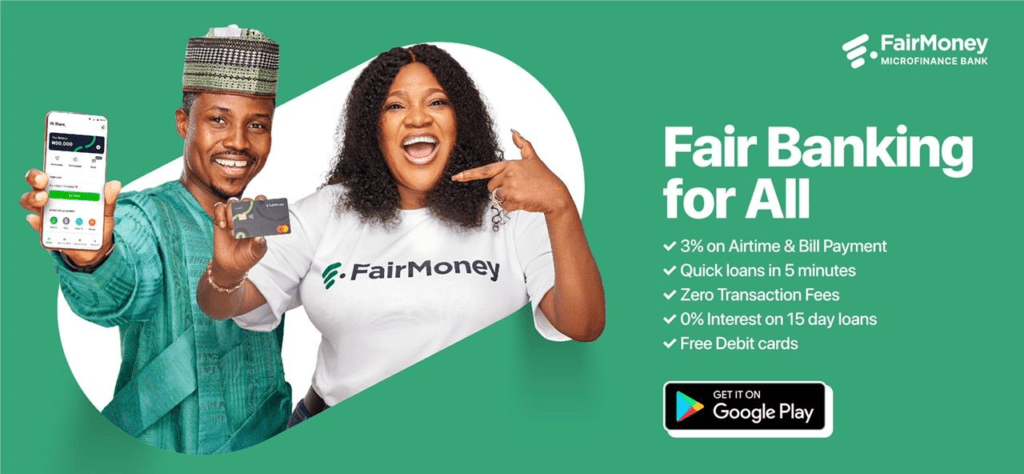

Everything you need to know about the FairMoney MFB Fair banking for all

Introducing Fair Banking for all, the new approach to banking. FairMoney Microfinance Bank recently announced it’s latest commitment to its customers far and wide and everyone has been asking what this means, how does this affect both old and new customers of the digital bank.

CEO and C0 – Founder of Fairmoney MFB, Laurin Hainy, he explained this, he said “Nigeria is a booming market with over 4 million young adults joining the adult population yearly; without the right inclusive infrastructures set to serve them, there will forever remain a lag. Thus why we’re moving forward to provide fair banking for all.”

Fair banking for all is FairMoney’s commitment to as many who are in need of financial services & opportunities to come forward and partake of it; particularly those in need of flexible banking services. Fair Banking by FairMoney MFB means; Account opening with zero balance, High interest investment opportunities, 24/7 access to reliable digital banking services, 3% discount on airtime and data purchase, Free FairMoney Debit cards, 100 free bank transfers monthly, hitch less Bill payments and access loans in as little as 5 minutes with 0% interest on loans repaid within a 15 day period.

Enjoy the new FairMoney – Fair Banking For All video…

For more information on FairMoney’s exciting offerings, follow FairMoney on Instagram, Twitter or Facebook or visit www.fairmoney.io